Our Offerings

The Fake Family of Companies

Our Family of Companies

Why Choose Fake?

The answer is simple: we do it all. The Foundation of our company is built on our client satisfaction, client endorsements and client referrals. We choose to work with retirees who prefer the guarantees of instruments that provide steady, predictable results.

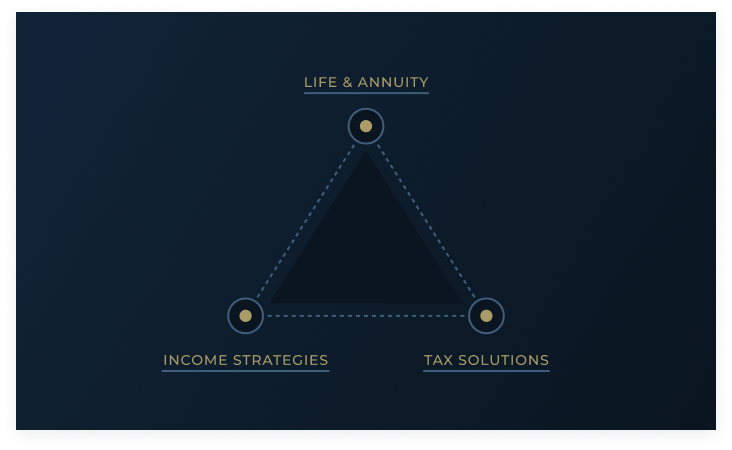

Income Strategies

Successful financial planning requires a customized plan designed to safely optimize individual returns. To this end, our team of Certified Financial Planners (CFPs), Certified Public Accountants (CPAs), and Certified Annuity Specialists (CSAs), licensed insurance representatives adhere to a rigorous and unique systematic process designed to meet each client’s individualized income goals utilizing fixed and indexed annuities.

Life & Annuity

Life insurance provides not only an invaluable tax-free death benefit for your heirs, it can also provide you cash accumulation, supplemental retirement income and some very attractive tax benefits.

Cash accumulation allows you to increase your death benefit, withdraw money in a lump sum for needed expenses, have a continuous source of supplemental income or build a tax-deferred nest egg… ensuring that you never outlive your cash.

Tax Solutions

Instituting a comprehensive tax strategy that will optimally benefit each individual client is an indispensable part of how we create your unique financial plan. Our team will customize a strategy to address your distinctive financial goals, utilizing fixed-index annuities and life insurance to provide optimum tax relief.

Additional Offerings

- IRA Strategies including RMDS

- Inherited IRAs Consultation

- Roth IRA Conversions Consultation

- 401K Net Unrealized Appreciation (NUA)

- Proper tax planning for buying or selling a home or rental property

- Charitable giving tax advice

- Assisted Living & Skilled Nursing Tax Preparation and Planning

- IRS Letter Consultation

- Monitoring tax changes and providing guidance and potential impacts to retirement strategy/planning

- Consultation on tax credits

- Small business tax preparation